ENG ver.

Hello, this is Pooh.

As of the end of May, my total financial assets have reached 5 million yen.

A few years ago, I had zero savings, but I have been steadily working on asset formation.

With the end of the pandemic and a significant recovery in economic activities, stock prices have also been improving.

Furthermore, my income has been gradually increasing, which I believe has contributed to enhancing my ability to make deposits.

This time, I have summarized the actions I have been taking for asset formation.

If you are struggling to increase your holdings, please consider these as references.

My current financial assets

As of the end of May 2023, here is the breakdown of my financial assets:

【5月】私の金融資産(投資歴5年10ヶ月目)

・投資信託 ¥ 3,120,372

・米国株 ¥ 880,770

・確定拠出年金 ¥ 1,038,098

・国内株¥ 51,818

評価額合計 ¥ 5,091,058

前月比 +¥ 280,307

前年同月比 +¥ 1,462,304

評価額ですが、やっと500万円に到達しました!#積立投資 pic.twitter.com/Y0B6VVD5FF— ぷーさん (@poohfinance) May 31, 2023

・Investment Trusts: ¥3,120,372

・US Stocks: ¥880,770

・Defined Contribution Pension: ¥1,038,098

・Domestic Stocks: ¥51,818

Total Portfolio Value: ¥5,091,058

Month-on-Month Change: +¥280,307 Year-on-Year Change: +¥1,462,304

I have finally reached the milestone of 5 million yen!

The allocation of my assets is primarily in investment trusts, followed by the defined contribution pension, US stocks, and domestic stocks, in that order.

I allocate approximately 100,000 yen per month for investments, and last month was a decent month with a significant increase in unrealized gains.

Systematic investment through mutual funds

Invest in index funds

I primarily invest in index funds through systematic investment plans.

The core of my portfolio consists of index funds that are composed of the US stock market.

The scale and profitability of American companies are overwhelmingly impressive, and I believe their presence in the economy will remain strong.

I prioritize index funds with low fees and the ability to achieve diversification across multiple companies.

Of course, I also utilize the NISA (Nippon Individual Savings Account) system.

Let’s make sure to take advantage of it in order to minimize taxes on investment gains.

【Specific Account】(特定口座)

- ニッセイ 外国株式インデックスファンド

- ニッセイ 外国債券インデックスファンド

- ニッセイTOPIXインデックスファンド

- ニッセイ新興国株式インデックスファンド

- eMAXIS Slim 全世界株式(オール・カントリー)

【NISA Account】(つみたてNISA口座)

- eMAXIS Slim 米国株式(S&P500)

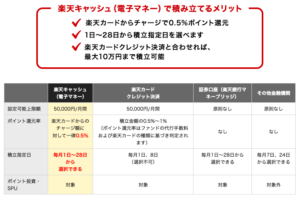

I set up a monthly contribution of 40,000 yen using Rakuten Cash

I opened an account with Rakuten Securities and use Rakuten Cash to settle payments for the aforementioned index funds.

Rakuten Cash is an online electronic money provided by the Rakuten Group. By charging it with Rakuten Card (楽天カード)and setting up automatic contributions, I can receive a 0.5% point rebate.

While there is a monthly limit of up to 50,000 yen, it is highly recommended because it guarantees a 0.5% return.

Recently, the rebate rate for Rakuten Card payments has also returned to 0.5% or higher. So, whether you use the normal card or Rakuten Cash, the rebate rate remains the same.

If you have the financial flexibility, setting up contributions with both Rakuten Cash and Rakuten Card will increase the rebate rate.

For those who frequently use Rakuten Market, it is also recommended to upgrade to the Gold Card and make contributions.

Personally, I have set up a monthly contribution of 40,000 yen using Rakuten Cash.

Since I have significant expenses this year, such as prep school fees, I have set the contribution amount slightly lower than the maximum and continue to make contributions.

Rakuten Point Investment

In addition to that, when you make everyday purchases with Rakuten Card(楽天カード), you can generally earn 1% worth of Rakuten Points.

Rakuten Points can be used at Rakuten Securities, so whenever I accumulate points, I make additional purchases of mutual funds.

By the way, please note that Rakuten Limited-Time Points obtained through campaigns cannot be used for purchasing financial products.

However, since Limited-Time Points can accumulate quite significantly, I personally use them to offset my monthly Rakuten Mobile fee or utilize them for hometown tax payments.

I use the funds obtained from my secondary income to make investments.

I make use of survey sites that allow me to earn points by answering daily surveys.

Currently, I am utilizing マクロミル、リサーチパネル(ECナビ![]() )、キューモニター .

)、キューモニター .

Although it may require consistent effort, diligently answering surveys can accumulate points equivalent to a total value of around 2,000 to 3,000 yen.

Reinvesting Dividends from Individual Stocks

I also engage in managing individual stocks, both domestic and US stocks, and receive dividend payments on a quarterly or semi-annual basis.

I reinvest the dividends earned from individual stocks into index funds.

Reinvesting Surplus Funds, Bonuses, and Other Income

By minimizing unnecessary expenses and reviewing fixed costs, I strive to maintain a positive monthly cash flow.

I aim to increase surplus funds and allocate them towards investments.

Additionally, bonuses serve as significant surplus funds, so I also invest them.

Furthermore, I allocate surplus funds from sources such as tax refunds, bank interest on deposits, affiliate income, and capital gains from stock sales towards investments, as they represent income beyond regular salary earnings.

Invest in US stocks

I primarily focus on building my assets through index funds, but I also engage in some individual stock investments.

Among them, I allocate a portion of my investments to US stocks. Many US companies operate on a global scale and demonstrate impressive profitability. Additionally, there is a widespread emphasis on shareholder value, resulting in numerous high-dividend stocks.

I believe it is worthwhile to hold US stocks with strong financial foundations, profitability, and high dividends.

Here are the stocks I currently hold

【Investment Stocks】

- Microsoft (MSFT)

- Intel (INTC)

- Procter & Gamble (PG)

- Coca-Cola (KO)

- McDonald’s (MCD)

- Johnson & Johnson (JNJ)

- AT&T (T)

I choose stocks that have solid financial foundations, strong profitability, and a history of consistently increasing dividends.

I have summarized my stock selection method in the following articles:

Monthly investment amount

As I prioritize index funds in my investment strategy, I ensure that the allocation to individual stocks does not become too high. Therefore, I allocate only ¥5,000 per month specifically for US individual stocks. I deposit this amount into PayPay Securities and make a purchase once a month, focusing on the stock with the lowest allocation in my portfolio.

Since I regularly receive dividend income, I reinvest those funds as well.

To avoid being overly concerned about price fluctuations, I adopt a mechanical approach of investing a fixed amount every month.

Investment in a defined contribution pension plan

I am enrolled in a corporate defined contribution pension plan through my company.

I allocate a total of 55,000 yen per month, consisting of both personal and company contributions, towards investment and management.

For the investment portfolio, I have chosen balanced funds that include bonds.

[Investment Products]

- DCインデックスバランス(株式60)

Investment in domestic stocks

I also engage in investing in individual stocks within the domestic market, albeit with small amounts.

I utilize platforms like Neomoba, which allows investment with T-Points, and Froggy, which enables investment with d-Points.

Since I accumulate points through my everyday shopping, I thought it would be a good idea to invest those points as well.

While I don’t have specific selection criteria, I tend to focus on mature companies with a dividend yield of around 3-5% and high brand recognition.

Both Neomoba and Froggy allow the purchase of stocks from just one share, so I aim to have a diverse portfolio by acquiring one share of various stocks.

Cut down on unnecessary spending

As mentioned earlier, I make it a priority to allocate the majority of my surplus funds towards investments.

To ensure I have surplus funds available, I strive to minimize unnecessary living expenses. For example, I use Rakuten Mobile for my phone service, have basic fire and medical insurance coverage through Tokin Kyosai, utilize the Furusato Tax Payment system to select daily necessities as return gifts and reduce living expenses, and try to shop at supermarkets instead of convenience stores whenever possible. These measures help me curb unnecessary expenses.

Developing a habit of saving not only helps with financial stability but also leads to personal growth by understanding what we truly need. Living in a clutter-free environment requires less maintenance and storage space.

By surrounding ourselves only with the things we genuinely need, we can not only reduce expenses but also free ourselves from unnecessary stress.

I believe that by minimizing wasteful spending and redirecting those funds towards asset building, we can make significant progress in our financial journey.

Self investment

Changed jobs

To increase my income, I actively pursued job opportunities and engaged in job hunting activities. Fortunately, I was able to secure a new job with a higher income.

Although my income has increased, I haven’t significantly elevated my lifestyle. Instead, I allocate a slightly larger portion of the surplus funds towards investments compared to before.

Previously, I lived with constant financial worries and struggled to make ends meet. However, now I have a bit of breathing room. While I can’t indulge in luxury, I can comfortably maintain a normal standard of living, which brings a sense of calmness to my mind.

Considering that my cash allocation is relatively low, I am contemplating the idea of increasing my cash reserves slightly.

I have taken care of my health

Over the past few years, I have been fortunate to maintain good health without any injuries or illnesses. I prioritize regular health check-ups, vaccination, and dental visits, while also paying attention to my diet, exercise, and sleep.

Continuing to prioritize a healthy lifestyle, this year I plan to focus on strength training and running.

I aim to continue building a body that defies age and maintains overall well-being.

Summary

I have summarized the actions I have taken to reach my target of accumulating assets worth 5 million yen.

The core of my asset building strategy has been investing in index funds through regular contributions, while also allocating additional income from dividends, side income from survey sites, and surplus funds resulting from expense reduction towards further investments.

I have also focused on self-improvement and maximizing my personal income.

As the mechanisms for saving money are gradually falling into place, I believe that by continuing to maximize my income, optimize expenses, and maximize investments, both my savings amount and savings rate will increase.

For the pursuit of side FIRE and FIRE, I am determined to continue dedicating myself to actions that I can undertake this year.

That’s all for now.

Thank you for reading.

Pooh

JPN ver.

コメント