ENG ver.

Hello, I’m Pooh.

This time, let’s think about “money-saving techniques to become wealthy.”

What kind of image do you have when it comes to saving money?

Many people tend to have negative perceptions of saving, such as it being difficult or feeling restricted in life.

However, did you know that those who are actually “wealthy” place great importance on saving?

By paying close attention to expenses, you significantly increase your chances of achieving financial freedom.

In this article, I explain the significant benefits that saving brings and introduce the money-saving techniques I personally practice.

Learning how to save is a necessary skill to get closer to becoming wealthy.

I believe that after reading this article, you will realize the importance of saving.

- The Benefits of Saving

- My Money-Saving Strategy

- Cutting Communication Expenses with a Budget-Friendly SIM

- Insurance: Prefectural Mutual Aid(都民共済)

- Shopping at the Supermarket

- Utilize Points

- Weekend Dining Out is Okay (Lunch is Recommended)

- Expense Management with a Budgeting App

- Cancel Unnecessary Subscription Services

- Utilize Hometown Tax Payment (ふるさと納税)

- Summary

The Benefits of Saving

You will be free from financial struggles

The first benefit that saving brings is the elimination of financial difficulties. Many people often find themselves struggling to make ends meet each month. This situation arises when living expenses exceed income.

For instance, let’s say your monthly take-home pay is 200,000 yen, but your living expenses amount to 250,000 yen, resulting in a deficit of 50,000 yen. While you might be able to rely on your savings to cover the shortfall temporarily, if this situation persists every month, your savings won’t grow.

Feeling the pressure of not being able to increase your savings despite working to earn enough for your monthly expenses perpetuates financial insecurity.

This predicament can affect individuals regardless of their high income levels. Even if someone earns a monthly take-home pay of 1 million yen, they may still experience financial anxiety if their expenses exceed that amount.

In other words, if you cannot maintain a suitable lifestyle within your income, everyone will face financial difficulties.

On one hand, there are people with high incomes who struggle financially, while on the other hand, there are individuals with low incomes who manage to avoid financial troubles.

By reevaluating your spending habits and practicing saving, you can achieve a sense of mental stability.

The Concept of “1,000 Yen Saved Equals 1 Hour of Work”

While it may be a simplification, it is not an exaggeration to say that saving 1,000 yen is equivalent to one hour of work.

For instance, if someone earns an hourly wage of 1,000 yen, they would need to work for one hour to earn that amount. On the other hand, if the same person aims to save 1,000 yen, what actions should they take?

For example, refraining from stopping by convenience stores on the way home, cutting back on dining out once, or cooking meals at home. These actions require significantly less effort compared to working for an hour and can help save 1,000 yen.

In monetary terms, “saving 1,000 yen” and “working for one hour” are equivalent.

Some salarymen may argue that they cannot sustain their lives without earning overtime pay. However, if they dedicate themselves to saving, reducing monthly living expenses by 10,000 to 20,000 yen becomes surprisingly achievable.

By saving enough to eliminate the need for approximately 10 to 20 hours of overtime, the burden of work can be lightened.

When faced with the choice of increasing their labor by one hour or making a small effort to save 1,000 yen to have it remain in their household budget, considering which option is more beneficial helps to recognize the value of saving.

Can saving on canned coffee expenses fund a trip abroad?

As the saying goes, “Every little bit adds up,” and by saving on daily canned coffee expenses, you might be able to afford a trip abroad.

There is often an association of “saving” with something plain or mundane, and it can feel like a slow process to deposit money into a savings jar every day.

However, even that small amount of money, when invested wisely, has the potential to grow into a significant sum in the future.

Let’s consider what would happen if you invested your daily canned coffee expenses over a period of 10 years.

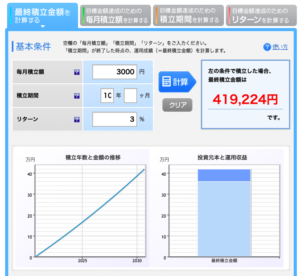

Assuming you spend 100 yen on a can of coffee every day: 100 yen × 30 days = 3,000 yen per month

If you invest this amount with an annual return of 3% for 10 years, what would be the result?

By simply giving up the 100 yen coffee and investing that money instead, you would have accumulated around 400,000 yen in assets after 10 years.

With 400,000 yen, you could afford a luxurious overseas trip or even purchase a reasonably priced used car.

While this may be an extreme example, it helps illustrate how even small amounts of savings can have a significant impact in the long run.

If you can achieve monthly savings at the level of tens of thousands of yen, you can build even larger assets.

Achieving Financial Freedom

Financial freedom refers to living solely off the returns from financial investments, such as stocks, without relying on other sources of income.

Specifically, it means having investment returns that exceed your living expenses.

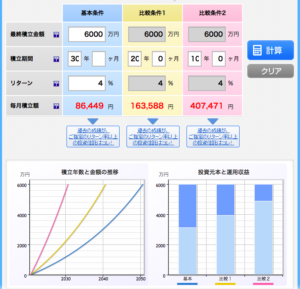

In the case of my spouse and me, our current monthly living expenses amount to approximately 200,000 yen. To achieve financial freedom, a common calculation method is to multiply the annual living expenses by 25.

For us, this means we would need a financial asset of 60 million yen (200,000 yen × 12 months × 25).

If we aim to achieve this goal in 30 years, we would need to make monthly investments of approximately 86,000 yen.

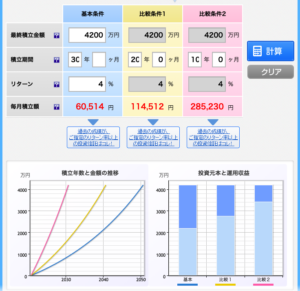

When the required monthly investment amount is high, reaching financial freedom can become challenging. However, by reducing living expenses through savings, the target amount also decreases.

For example, if we can reduce our living expenses to 140,000 yen, the required financial asset would be 42 million yen. In this case, achieving financial freedom in 30 years would only require a monthly investment of approximately 60,000 yen.

By minimizing living expenses to the bare minimum, even with a modest income, the attainment of financial freedom becomes more realistic.

For those aiming for a financially stable life, I recommend starting by understanding your own and your family’s necessary living expenses and setting a target investment amount.

By practicing savings, you can gradually free yourself from the constraints of excessive work.

Distinguishing Needs from Wants

Through the practice of saving and reviewing expenses, you often become aware of unnecessary spending.

You start questioning why you bought certain things and whether they were truly necessary.

By finding meaning and benefits in saving, you can clearly distinguish between what you genuinely need and what you don’t.

Even if you bought something expensive to impress others, it may turn out to be unnecessary.

By reducing wasteful expenditures, you can allocate money to things that truly matter.

For example, the money you used to spend on casual dining out can now be used for self-improvement or maintaining good health.

When examining your financial flow, it’s important to pay attention not only to the money coming in but also to how you spend it.

By reevaluating your spending habits through savings, you can make more meaningful and fulfilling expenses.

My Money-Saving Strategy

Cutting Communication Expenses with a Budget-Friendly SIM

Reevaluating fixed expenses is a crucial step in reducing overall living costs. Compared to the past, there have been significant reductions in mobile phone fees, and even major carriers now offer affordable plans.

Switching to a budget-friendly plan or opting for a budget-friendly SIM card is an effective method to decrease monthly communication expenses. For instance, I personally use and recommend Rakuten Mobile, which allows for significantly cheaper communication services.

Not only am I satisfied with the quality of their network coverage, but I can also accumulate Rakuten points. With various companies offering similar services, I encourage you to consider your usage and network coverage when choosing a provider.

By switching to a budget-friendly SIM card or plan, you can substantially reduce your monthly communication expenses while enjoying reliable network quality.

Insurance: Prefectural Mutual Aid(都民共済)

Prefectural Mutual Aid is a type of insurance that my spouse and I have also enrolled in. It provides basic coverage for hospitalization, death, and residual disability, among other things, with monthly premiums kept at 2,000 yen per person.

都民共済の割戻金の通知が来ました。割戻率37.31%で一人あたり7,754円のバック。保険料が戻ってくるっていいね。#都民共済 #割戻金 #保険 pic.twitter.com/K9rjw0XARN

— かねのぷーさん@少額投資家 (@poohlivestokyo) June 25, 2020

In fact, we also received a refund notice from Prefectural Mutual Aid. The refund rate was 37.31%, and we received 7,754 yen per person. It’s satisfying to have insurance premiums returned.

Since Japan has a well-established social insurance system, there is no need to spend excessively on insurance. It is important to calculate the necessary coverage in the event of an emergency and review the required compensation accordingly.

Shopping at the Supermarket

Let’s use supermarkets for our daily grocery shopping.

While eating out or convenience stores are convenient and easy, they tend to be more expensive.

The cost of instant foods and pre-packaged meals, which are consumed in a single serving, also adds up.

Supermarkets offer ready-made dishes and bento boxes, but it’s better to buy ingredients and cook at home whenever possible.

Prices at supermarkets are generally cheaper compared to convenience stores, and they often have discounts in the evening.

Recently, many supermarkets have introduced point reward services, so be sure to take advantage of them.

Utilize Points

Make effective use of point reward services.

You can use accumulated points to offset the cost of purchasing products or even invest with them.

I primarily use Rakuten Points.

Rakuten Points can be used for purchasing items on Rakuten Market, paying for mobile communication costs with Rakuten Mobile, and buying investment trusts through Rakuten Securities. The range of services is quite extensive.

ポイントサービスも有効活用していきましょう。

楽天ポイントで投資信託を追加購入しました。846円分購入しました。#楽天ポイント #投資信託 pic.twitter.com/oQwd0INqDc

— かねのぷーさん (@poohlivestokyo) October 1, 2020

Weekend Dining Out is Okay (Lunch is Recommended)

It’s not good to be too focused on saving money, so let’s occasionally dine out.

For dining out, I recommend having lunch.

Even at famous or high-end restaurants, you can enjoy a meal for around 1,000 yen during lunchtime.

I have meals at home on weekdays and enjoy dining out for lunch on weekends.

Dinner at restaurants often costs over 3,000 yen, so I prefer to have dinner at home.

Expense Management with a Budgeting App

To control expenses, it’s necessary to grasp your spending, but keeping a physical record of expenses can be quite burdensome.

However, by using a budgeting app, you can easily track your expenses.

I use MoneyForward.

By registering your bank accounts and credit card information in the app, your transactions are automatically recorded, making it easy to understand your monthly expenses by simply checking once a month.

Cancel Unnecessary Subscription Services

Due to the impact of the recent pandemic, there have been more opportunities to spend time at home.

Many people have subscribed to video streaming services like Netflix.

However, even after subscribing, you might find that you don’t actually use them as much as expected.

If you find that you are not using a service much and the subscription remains idle, it’s best to cancel it.

For instance, I currently only subscribe to Amazon Prime Video.

With a monthly fee of 500 yen, it is relatively inexpensive compared to other providers, and the content selection is extensive.

As a Prime member, you also gain access to Amazon’s sales, Prime Music for music streaming, and Prime Reading for reading books, making it highly recommended.

Utilize Hometown Tax Payment (ふるさと納税)

Through the Hometown Tax Payment system, you can receive advantageous return gifts by making a prepayment for local taxes.

The return gifts include food products and daily necessities, which can contribute to saving money.

In my case, I chose to receive rice and a large amount of pork this year.

As a couple, we have enough to last for two to three months.

It saves the effort of shopping and the following year, the local tax is deducted, so let’s make good use of this system.

【ふるさと納税】

宮崎県都城市からの返礼品が届きました。都城産の豚肉4kgです。9パックとかなりボリュームがあります。当面は豚肉は買わなくて済みそうです。おいしくいただきます。#ふるさと納税 #都城市 pic.twitter.com/IGJ4UXTZ4Z— かねのぷーさん (@poohlivestokyo) September 10, 2020

Summary

To achieve a financially stable life, saving money is an essential strategy. While hard work is universally recognized, saving money doesn’t always have a positive connotation. However, from a financial perspective, both working and saving money bring equal value.

By reviewing your living expenses, you can bring about mental stability and make the achievement of financial freedom more realistic. Additionally, carefully reassessing your expenses helps clarify what is truly necessary and what is not. Understanding where your money should be spent can also contribute to personal growth.

Instead of mindlessly spending money, why not try to make savings a meaningful part of your life? Embrace saving money with a positive mindset.

Thank you for reading this far.

Pooh

JPN ver.

コメント