ENG ver.

Hello, this is Pooh-san.

The conflict in Ukraine has started, and the world situation is undergoing significant changes.

Unexpected events and extraordinary occurrences have become increasingly common in a world where anything can happen.

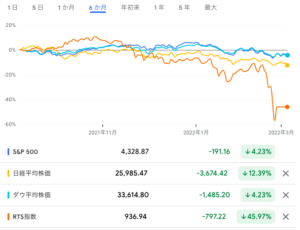

In the midst of all this, stock prices are also fluctuating greatly.

On Twitter, I often come across posts about people quitting or exiting investments.

With the recent investment boom, I believe many people have mustered the courage to start investing their own money. However, I understand the feeling of wanting to quit when you see your assets shrinking.

Nevertheless, I think it would be a great waste to give up on investing after starting it.

Personally, I am pursuing long-term accumulation investment for retirement savings and achieving Financial Independence, Retire Early (FIRE). I plan to continue steadily investing.

For those who are currently contemplating whether to continue investing, I have summarized my own perspective, and I would be delighted if it can be even a little helpful.

My investment style is “long-term accumulation investment.”

My personal investment style is “long-term accumulation investment,” where I diligently engage in systematic investments every month.

The purpose of my investment is strictly for “retirement savings” and “achieving FIRE.”

With interest rates on regular deposits almost at zero, it is necessary to form retirement savings through investments.

Furthermore, as the invested amount grows, it becomes possible to maintain an annual living expense without depleting the assets by withdrawing within the range of 4% (referred to as the 4% rule).

If you can cover the minimum cost of living, it also increases the freedom in choosing work and how to spend your time.

I continue investing for the assurance of retirement expenses and the freedom to live a little further into the future.

Investing requires the ability to make deposits.

As my take-home income is not currently high, I am actively working towards improving my expenses, focusing on my main occupation, self-investment, and generating additional income through blog operations and other side jobs.

I allocate surplus funds generated from monthly income and direct them towards investment through schemes like “NISA” (Nippon Individual Savings Account) or other accumulation investments.

Although the investment amount each month may be small, as investments can generate compound interest over time, I continue investing within my current capabilities.

Even if you have only 10,000 yen in available funds, the value of keeping it in a bank deposit versus investing it will show a significant difference as time passes.

When major events like the current situation occur, there may be a temporary decline in asset value. However, when viewed in the long term of 30 to 40 years, it can be seen as a minor adjustment phase.

Additionally, significant downturns are often considered excellent buying opportunities, so it is entirely possible that investments made now will yield substantial returns in the future.

The advantage of long-term accumulation investment lies in the tendency to revert to the mean as time goes on.

Based on this perspective, considering the situation in Ukraine, I have no intention of selling off my assets. However, I am curious to know what your thoughts are on this matter.

It is necessary to reconsider the allocation if there is a higher proportion of investments in emerging markets

On the other hand, when there is a change in the political situation, such as the current one, it is important to consider how it may affect the markets where you have invested.

Stocks related to Russia, for example, have experienced significant declines, and the economy itself is in a situation where it is cut off from international trade.

I believe it is necessary to review whether the stocks I hold are affected by such country risks.

By the way, most of the stocks I hold are investment trusts linked to the American market.

I have domestic stocks, global equity index funds, individual US stocks, and bond funds as well, but index funds that track the S&P have a significant proportion.

Personally, I believe that the American market is essential in investing.

I think it has a high market advantage compared to other countries, and the following reasons can be cited:

- Many companies operate on a global scale and have a strong earnings structure.

- There are numerous companies that have continuously increased dividends for decades, and the concept of returning value to investors is well ingrained among managers.

- The US population is expected to continue to increase, and there is future potential in the domestic market.

- Compared to countries like China and Russia, the political risk is lower.

- It has a concentration of universities and research facilities, and unicorn companies are emerging one after another.

These are just a few examples, but I believe there are many advantages and future prospects in the American market.

Continue with systematic investment without panicking and selling off in a rush

I believe it is important to continue with regular and steady investment without panicking and selling off assets.

At this point, I don’t see any issues with the investment portfolios or the allocation across different countries, so I will continue with my regular investment approach as before.

Even for those who are unsure about what to do with their holdings, if they believe in the future potential of their investment choices, I think they should continue with their regular investments.

Quitting investments would be a waste, and alternative methods of asset formation need to be considered.

Regular investment may seem modest, but it allows for risk diversification. If we consider other methods, we may be inclined to take higher risks. Personally, I do not recommend that.

On the other hand, if we avoid taking risks altogether, we are left with low-interest bank deposits that increase by only a few yen or a few hundred yen. It is difficult to consider it as a means of asset formation.

For me and many others, once we have chosen suitable investment options, we set up automatic withdrawals for regular investments and let it run in the background. It is healthy to find joy in our daily lives, whether by pursuing hobbies, spending time with family, or engaging in activities that contribute to the world.

Not only in Ukraine but also in the Middle East, Africa, and other regions, conflicts continue to persist.

I hope for a world where conflicts cease as soon as possible.

Pooh

JPN ver.

コメント