ENG ver.

Hello, this is Pooh.

Today, let’s consider the question of “Index investing vs individual stock investing, which is better?”

Personally, I primarily engage in index investing, but I also dabble in individual stock investing.

Up until now, I have been dividing my monthly investment amount almost equally between index funds and individual stocks.

Both have steadily generated returns for me, but the growth of assets in index funds has been slow, while individual stocks, though more volatile, have shown significant growth during certain periods.

However, as the amount of assets increases, I have become more concerned about the specific risks associated with individual stocks.

Therefore, I have decided to reevaluate my investment strategy.

- Make index investing the main focus.

- Make individual stock investing the main focus.

- Continue investing in both with the same allocation.

- Stop both types of investments.

Now, let’s take a closer look at the characteristics of index investing and individual stocks to reassess which approach is more suitable for me.

My current investment situation

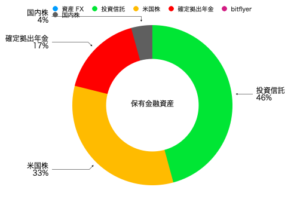

Regarding my current investment situation, the graph above illustrates the allocation percentages.

Currently, investment trusts account for 46%, US individual stocks for 33%, defined contribution pension for 17%, and domestic stocks for 4% of my holdings.

- Should I increase the allocation of investment trusts such as those focused on the US market or global index funds?

- Should I increase the allocation of individual stocks?

- Should I continue investing in both investment trusts and individual stocks with the same allocation?

- Should I stop both investment trusts and individual stocks?

I initially started investing in both investment trusts and individual stocks because they were recommended online.

While the initial motivation was sufficient, I believe it’s important to once again clarify the characteristics of each investment method.

The characteristics of index funds

The characteristics of index funds can be summarized as follows:

- Tracking specific indices: Index funds are designed to replicate the movements of specific indices that are frequently mentioned in the news, such as the Nikkei Average, TOPIX, Dow Jones, S&P, and others. Their unique feature is that they closely follow the performance of these indices.

- Enable broad market diversification: Index funds aim to replicate the performance of an index by holding a predetermined selection of securities in proportions that reflect the overall market. By owning an index fund, you can achieve the benefits of diversification across the entire market. In other words, holding a single index fund allows you to gain exposure to the broader market.

- Difficult to achieve significant short-term returns: Index funds generally exhibit less extreme price volatility compared to individual stocks and tend to experience gradual price movements. This means that it can be challenging to achieve substantial returns of tens or hundreds of thousands of yen within a short period. Index funds are known for their more stable and moderate return profiles.

The characteristics of individual stocks

On the other hand, individual stocks have the following characteristics:

- Ability to reflect personal beliefs: One significant advantage of investing in individual stocks is that you can incorporate your own ideas and strategies into your portfolio. Even when the overall market, represented by indices like the Nikkei Average, is performing poorly, there are individuals who manage to generate profits. By identifying stocks that are trending upwards against the market or stocks that outperform the market decline, you can tailor your portfolio to align with your own investment beliefs.

- Targeting high-dividend stocks: There are numerous individual stocks that offer high dividend yields. By selectively including such high-dividend stocks in your portfolio, you can create a portfolio that generates substantial dividend income. Additionally, by holding a certain number of shares, you may also benefit from shareholder perks, which further adds to the appeal of individual stocks.

- Tendency towards concentrated investments by individual investors: One significant drawback of individual stock investing compared to index investing is the lack of diversification. It requires experience and skill to allocate and rebalance funds effectively. Moreover, for individual investors like myself with limited investment capital, investing in individual stocks can lead to a higher concentration of investments. It is crucial to be mindful of this potential risk when considering individual stock investments.

What is the significance of investing in index funds and individual stocks in equal proportions?

The decision to invest in both index funds and individual stocks with the same allocation does not have any definitive advantages. However, I believe there is a benefit in gaining investment experience by diversifying between index funds and individual stocks.

By investing in both, you can learn about the dynamics of stock movements, understand the meaning of specialized terms, and appreciate the respective advantages and disadvantages of index funds and individual stocks. These experiences are valuable in building your investment knowledge.

However, it is important to recognize that consistently outperforming the index through individual stock investing can be more challenging than expected.

While it is not difficult to outperform the index in the short term, it becomes increasingly challenging over longer investment periods.

参考:インデックス投資と個別株投資の片方しかやってはならないというルールはない

(It is worth noting that there is no rule stating that one must only engage in either index investing or individual stock investing.)

Over an extended period, investment trusts can generate returns of around 20%, but surpassing this return with individual stocks is extremely difficult. Individual stocks are subject to significant price fluctuations due to factors such as company bankruptcies, underperforming financial results, and scandals. Additionally, social media posts can also have an impact on stock prices.

Having exposure to a wide range of investment approaches can provide valuable learning experiences.

There is no one-size-fits-all investment strategy.

However, it is essential to understand the characteristics of the investment approach you are considering and carefully allocate your valuable funds accordingly.

I have decided to focus on index investing as the core strategy for building my wealth.

In my case, I have made the decision to primarily pursue asset formation through index investing moving forward.

The purpose of my investments is to build retirement savings and achieve financial independence, also known as FIRE.

I do not engage in stock analysis or short-term trading like a professional investor would.

Instead, I adopt a long-term approach and believe that selecting and managing individual stocks can be challenging.

Therefore, I believe that a balanced approach would be to focus on index investing for retirement savings while gradually purchasing individual stocks with any surplus funds.

I plan to allocate my surplus funds and additional income to index funds, while setting aside around 5,000 yen per month to gradually invest in individual stocks.

As a beginner, I intend to gradually increase my holdings in low-risk index funds, ensuring a reliable path to wealth accumulation.

Book Recommendations

Finally, I would like to recommend some books on index investing and individual stocks that I have personally found valuable.

- “The Little Book of Common Sense Investing” by John C. Bogle

This investment classic is written by John C. Bogle, the founder of investment management company Vanguard Group. The book advocates investing in index funds as the simplest and most effective way to succeed in the market. Bogle argues that by purchasing and holding index funds indefinitely, one can reliably capture a fair share of the stock market’s returns. Highly praised by Warren Buffett and many other investors, it is regarded as a solid guidebook for building a sound financial future.

- 『貯金感覚でできる3000円投資生活デラックス』Written by Mitsuo Yokoyama

This introductory book explores methods for asset formation through index funds, starting from a monthly investment of 3000 yen. Yokoyama asserts that by purchasing and holding index funds for the long term, one can consistently attain market returns. The book provides basic knowledge about investments and specific stock selections, presenting information in an easily understandable manner. It also includes numerous examples and simulations that allow readers to reference situations similar to their own when starting their investment journey.

Summary

In this discussion of “Index Funds vs. Individual Stocks,” we have revisited the characteristics of index investing and individual stock investing. As the allocation to individual stocks in my portfolio has gradually increased, I wanted to review my future investment strategy.

While I don’t see many advantages in simultaneously investing in both index funds and individual stocks, I believe it can be beneficial in terms of gaining investment experience since they each have distinct characteristics. However, it’s important to note that it can be challenging for beginners to outperform the market with individual stock selection, so careful consideration should be given to where to focus asset formation.

In my case, I aim to build retirement savings over the long term. My strategy is to make index funds the core of my investments, purchase individual stocks with surplus funds in small amounts, and continue with systematic investment plans.

When determining investment options, it’s important to choose based on goals and investment time horizon.

If seeking short-term returns, individual stocks may be suitable, but for beginners considering long-term investments, I recommend pursuing reliable asset formation through index funds.

I suggest finding an investment style that suits oneself and gaining experience through various investments using surplus funds.

Thank you for reading until the end.

Pooh

JPN ver.

コメント