ENG ver.

Hello, I’m Pooh.

This time, I would like to write about the purpose and goal of investing.

For those who are still unsure about their investment purpose and goals, I will address the following questions:

- “How to find the purpose of investing”

- “How to determine investment goals”

- “What should be done to achieve those goals”

So far, I have been sharing information about investment methods that even beginners can use.

However, I believe there are people who are unsure about “why they should invest” or “how long they should invest for,” meaning their investment purpose and goals are not clear.

That’s understandable because predicting the future is difficult, and it’s challenging to imagine even our own circumstances, let alone the world.

However, there’s nothing wrong with envisioning the life you want to achieve in the future. Having goals and striving towards them is essential for personal growth.

While it may be difficult to predict what kind of person you will become or your individual ideal, setting goals related to your desired lifestyle in economic terms can be easier, allowing you to determine the actions you should take right away.

Furthermore, without investment purpose or goals, you may start questioning why you are investing every month. You might also be tempted to invest in high-risk products out of a desire to quickly increase your wealth.

Establishing the purpose and goals of your investments helps prevent wavering in your actions and decision-making.

Finding the purpose of investing

Step 1: Consider your ideal lifestyle

To find the purpose of investing, the first thing to do is to think about your ideal lifestyle.

It might seem difficult at first, but try to imagine the kind of life you want to lead from now on.

For example, if you’re currently working as an employee and have no free time due to long hours and even working on weekends, you might envision an ideal state where you have more free time for yourself.

As for myself, I love traveling abroad, so I imagine a life where I can work moderately in a country I like, doing a job I enjoy, at a time and place of my choosing. I want to have time with my family and decide how I spend each day.

Everyone’s ideal lifestyle is different, and there’s no need to limit your vision. Feel free to think about it here.

Setting investment goals

Step 2: Consider how much is needed annually for that ideal lifestyle

Now, let’s think a bit more realistically. How much would you need annually for that ideal lifestyle?

Let’s calculate it based on the minimum amount. In my case, I estimate it to be around 200,000 yen per month (2.4 million yen annually) for expenses like rent, utilities, and food for a couple.

Even if it’s difficult to determine an exact amount, let’s calculate an approximate figure for now.

Step 3: Save an asset 25 times that amount.

Let’s calculate it by multiplying the annual living expenses we calculated by 25.

In my case, I have 2.4 million yen per year, so 2.4 million yen multiplied by 25 equals 60 million yen.

This 60 million yen becomes the target amount for achieving the ideal lifestyle.

As for the calculation method, if we invest 60 million yen at an annual interest rate of 4%, the investment return would be 2.4 million yen. The idea is that with this investment return, we can cover our annual living expenses.

In other words, it means being able to live solely off the investment returns without needing to work.

This concept is known as the “4% rule,” and it seems that more people in the United States are considering it as an option for semi-retirement based on this idea. It has also been gaining some attention in Japan recently.

By the way, the number “4%” is derived from subtracting the U.S. inflation rate of 3% from the growth rate of the U.S. S&P index, which is 7%.

Since Japan’s inflation rate has been below 1%, it is considered that a range of “17 to 20 times annual expenses” would be applicable in the Japanese context. However, for now, let’s stick with the U.S. version and consider 25 times the annual expenses.

Calculating the required monthly investment amount

Step 4: Calculate the monthly investment amount

Now, let’s determine how much you need to invest each month to accumulate that 60 million yen. We can calculate it using a simulation tool.

You can use the following simulation website:

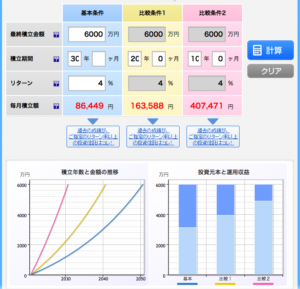

Assuming a final investment amount of 60 million yen and a return rate of 4%:

- For a savings period of 30 years: Monthly investment of 86,449 yen

- For a savings period of 20 years: Monthly investment of 163,588 yen

- For a savings period of 10 years: Monthly investment of 407,471 yen

As you can see, in order to achieve your ideal lifestyle, you need to set a target investment amount and a desired timeframe, calculate the required monthly investment amount, and start investing accordingly.

Even without tackling anything particularly difficult, you can achieve your dreams and aspirations through a very simple method.

However, it’s quite challenging when you realize the substantial monthly investment amounts required.

To be honest, I currently don’t have the financial capacity to make such monthly contributions.

But on the other hand, this also means that with this level of financial capacity, you can achieve your ideal lifestyle.

First, it’s important to assess your current situation and identify the challenges. By doing so, your vague investment goals can become more concrete.

In that sense, I believe it’s beneficial to calculate the target amount at least once.

Actions to generate surplus funds

Step 5: Review living expenses

Now, let’s start taking steps from what you can do to secure even a small portion of the desired investment amount.

Why is it necessary to review your living expenses? I believe that the funds you have available for investment are mostly from surplus funds (it’s unlikely that you can invest funds without paying your rent, right?).

While increasing your income may seem necessary to increase your investment funds, for salaried employees, it’s not something that can be immediately raised.

Surplus funds refer to the difference between income and living expenses. Therefore, I consider reviewing your living expenses as a highly effective and immediate way to secure surplus funds.

Effective cost-cutting measures: Reviewing fixed expenses

In particular, I believe that reviewing fixed expenses is highly effective.

Unlike variable expenses such as food and daily supplies, once you review fixed expenses, you can reduce your living expenses without much effort.

Among fixed expenses, one area that is relatively easy to address is your monthly communication expenses, such as your smartphone bill.

Especially if you are currently using one of the major carriers, consider switching to a more affordable SIM card provider.

I, too, used to be a DOCOMO user, but now I use Rakuten Mobile, and I’ve managed to reduce my communication costs to about 1,500 yen per month.

By doing this, you can save several thousand yen per month, so I highly recommend giving it a try.

Reevaluate life insurance and medical insurance.

Having worked as an insurance agent at a company I joined after graduating, I’ve seen many customers who were unnecessarily over-insured.

Sales representatives are evaluated based on the insurance premiums they sell, so it becomes a point of pride to include as many additional clauses as possible in the policies. That may be one reason why many people have multiple insurance policies.

However, on the other hand, Japan’s social insurance system is quite comprehensive compared to other countries.

Even if you incur high medical expenses, the high-cost medical expense system sets a limit on the out-of-pocket burden, ranging from 35,000 yen to 250,000 yen, depending on your income.

Additionally, if you have to take time off work due to illness or injury, you can partially cover your income with health insurance’s sickness and injury allowance. And in the event of unemployment, you can receive compensation through unemployment insurance.

【High-Cost Medical Expense System】

【Sickness and Injury Allowance】

【Unemployment Insurance】

Despite the existence of these public guarantees, I believe many people tend to overlook their coverage and focus on calculating the necessary compensation for illnesses or injuries.

Instead, it’s necessary to consider using insurance products to complement areas where social and health insurance coverage may be insufficient.

Therefore, I think many people who have multiple insurance policies can benefit from reevaluating their coverage.

By doing so, you can reduce your monthly insurance premiums and secure surplus funds. I encourage you to consider this option.

Cut back on wasteful spending.

I understand the temptation to buy snacks and drinks at convenience stores. However, let’s try to minimize our use of convenience stores.

The issue is that prices at convenience stores tend to be slightly higher.

When buying snacks and drinks, try to use supermarkets as much as possible to reduce costs.

The same goes for convenience store meals and cup noodles.

If possible, avoid instant foods or retort pouch meals that are meant for single consumption. Instead, buying ingredients at a supermarket allows you to divide them into several meals, significantly reducing the cost per meal.

Although it requires some effort in cooking, try to balance between cooking simple dishes yourself and relying on frozen foods or deli items for slightly more complicated dishes.

Reducing the frequency of eating out will further enhance the effect.

Cooking your own meals is not only healthier but also helps save money, so try to purchase ingredients and cook at home as much as possible.

Step 6: Increasing income

Once you have reviewed your fixed expenses and managed to reduce your living costs, it’s time to consider increasing your income.

There are various ways to increase your income, but it can be more challenging and may require time and effort compared to cutting expenses.

Specifically, for employees, there are several main methods to consider: increasing your salary within your current company, getting a promotion or a managerial position, earning incentives or overtime pay, and exploring side jobs for additional income.

For salaried employees, you can potentially increase your income by advancing in your job position, taking on managerial roles, earning performance-based incentives, or receiving overtime pay.

If you work for a company with a robust performance evaluation system that offers opportunities for salary increases based on individual achievements, strive to excel and demonstrate your capabilities.

Consider job change

If your current salary falls below the average for your age group, or if you work in an industry with lower average salaries, it may be necessary to consider a job change. Salary levels can vary not only based on individual skills but also depending on the industry and the financial performance of companies within that industry.

Even individuals with similar skills may experience salary disparities simply due to the industry they are in.

Instead of solely focusing on your individual skills, take into account the industry your current company belongs to, its current situation, and future prospects when considering a job change.

If your current workplace involves excessive overtime, excessive mental or physical stress, or lacks a healthy work-life balance, it may be worth considering a job change promptly.

There is no job in this world worth sacrificing your health for. Once your physical or mental condition deteriorates, it becomes challenging to recover, so please be mindful of this.

転職成功の秘訣は【非公開求人】にあった!/DODAエージェントサービス

Start a side job

Another method is to engage in a side job.

Due to the impact of COVID-19, many people have experienced a decrease in income, temporary closures, or have extra time available while working remotely. This has led to an increased interest in starting a side job.

There are various types of side jobs, such as part-time jobs, online marketplaces, reselling, blogging, forex trading, writing, programming, and becoming a YouTuber.

Among these options, I recommend exploring online-based side jobs. They do not require fixed costs like office or store rent, allow for lower procurement costs of products, and eliminate the need to manage inventory, which are all advantages.

Furthermore, if your side job has the potential to grow significantly in the future, it may become a job that is not constrained by location or time.

In my case, I started and have been running a blog that you are currently reading. It has been around five months since I started, and I haven’t reached the stage of monetization yet, but the number of readers is gradually increasing.

In the future, I aim to improve my writing skills to deliver more understandable articles and ultimately generate income through the blog.

Step 7: Increasing investment through point investing

To further increase your investment capital, let’s explore the option of point investing.

With the advancement of cashless transactions, various companies have been implementing point reward programs.

Typically, points can be used for discounts or exchanged for goods. However, recently, there has been an increase in companies offering investment services using points.

One example I personally utilize is investing with Rakuten points.

At Rakuten Securities, you can use accumulated Rakuten points (normally earned through purchases) to buy stocks or investment trusts.

Rakuten is a company that extends its services to various aspects of daily life, including mobile, internet, electricity, insurance, and banking. By consolidating your services with Rakuten, you can automatically accumulate a significant number of points every month.

Since 1 point is equivalent to 1 yen, points hold the same value as cash when purchasing financial products.

Recently, it has become possible to invest using points from other reward programs such as T-points or d-points. If you find points that are easy to accumulate, I highly recommend utilizing them for investment purposes.

By the way, I personally use Rakuten points to make additional purchases of investment trusts.

I can use my Rakuten points to purchase investment trusts worth 2,000 to 3,000 yen every month.

楽天ポイントで投資信託を追加購入しました。通常ポイントが100ポイント貯まったらせっせと購入してます。(SPUアップのため月初は500ポイント以上貯まってから購入してます。)#楽天ポイント #積立投資 pic.twitter.com/cBKOllxwJi

— Pooh@Tokyo (@poohlivestokyo) August 24, 2020

If you plan to utilize Rakuten services, it is recommended to start by creating a “Rakuten Card.”

What if achieving the goal is still difficult?

Step 8: Adjust the target amount when the goal is challenging

While it may be possible to review your living expenses to some extent, increasing your income can be quite challenging.

In fact, even I have recently started a blog, but I haven’t been able to increase my income or invest significantly yet.

If things continue like this, it can become difficult to maintain the motivation and may even risk giving up on the desired ideal lifestyle.

During such times, I recommend adjusting the set goals slightly.

For example, instead of aiming to cover all expenses, including food and entertainment, with investment returns, consider setting a goal for semi-retirement where only rent and utility bills are covered by investment returns. This way, you can partially achieve your ideal lifestyle.

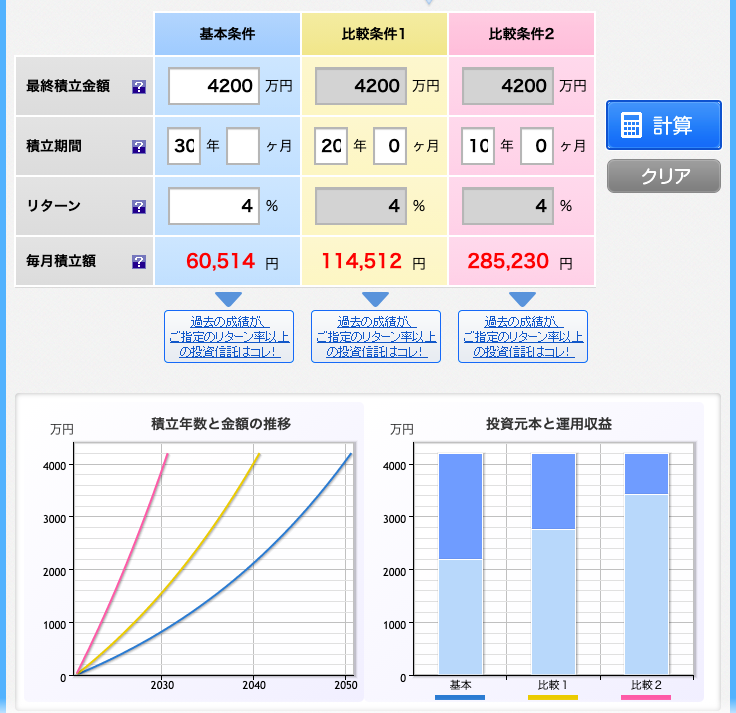

As an example, assuming only rent and utility bills are covered by investment returns, the monthly amount would be around 140,000 yen (1.68 million yen annually), with a target amount of 42 million yen.

Final accumulation amount: 42 million yen Return: 4%

- For an accumulation period of 30 years: 60,514 yen per month

- For an accumulation period of 20 years: 114,512 yen per month

- For an accumulation period of 10 years: 285,230 yen per month

Comparing these figures to the previous investment amounts, they seem more realistic, right?

If a couple can manage 60,000 yen per month, it seems possible to achieve this goal.

If the initial target amount seems too far-fetched, I recommend changing the goal to a partial realization of your ideal lifestyle.

If you have taken the actions mentioned so far, you should be able to review your living expenses thoroughly and increase your income from your main job or side gigs. This is the case for most people.

Even achieving small goals can generate a sense of significant accomplishment, and as the situation improves, gradually adjusting the target amount upwards from the initial goal can help maintain motivation for investing and saving.

Let’s start by clearing the goals right in front of us, step by step.

【Reference】Mitsubishi Salaryman

It’s worth noting that there are individuals who have thoroughly followed these steps and achieved semi-retirement by the age of 30. One example is Mr. Yuki Hodaka, also known as Mitsubishi Salaryman.

He shares information on Twitter and has published a book as well.

I recently purchased and read his book, and his thoroughness is remarkable.

Reading it once can be highly informative and can also boost motivation. I highly recommend it.

【Twitter】https://twitter.com/FREETONSHA?s=20

Summary

【Finding the Purpose of Investing】

- Step 1: Consider your ideal lifestyle.

【Setting Investment Goals】

- Step 2: Determine how much you need annually for that ideal lifestyle.

- Step 3: Accumulate assets 25 times that amount.

- Step 4: Calculate the monthly contribution amount.

【Actions to Generate Surplus Funds】

- Step 5: Review your living expenses.

- Step 6: Increase your income.

- Step 7: Increase the investment amount through point investment.

【When Achieving the Goal is Still Difficult】

- Step 8: Adjust the target amount if achieving the goal is challenging.

So far, we have discussed “how to find the purpose of investing,” “how to set investment goals,” and “what to do to achieve the goals.”

The path to an ideal life and becoming financially successful is actually quite simple.

By setting a target amount that exceeds living expenses and investing the required amount monthly within a specified period, you can achieve your goals.

However, I understand that securing the monthly investment funds can be quite challenging.

Since it’s necessary to generate surplus funds ranging from tens of thousands to hundreds of thousands of yen each month, many people may give up.

Honestly, it is difficult, but I believe it is worth trying at least once.

I want to make my ideal lifestyle a reality, and I believe that challenging new things can enrich our lives.

I absolutely don’t want to spend my days in a vague manner, so I strongly feel that we should keep challenging ourselves.

For those who are starting their investment journey, while it is essential to learn about investment products and strategies, setting a purpose and goal for your investments can also inspire ideas for suitable investment approaches.

Please consider referring to the steps mentioned here and define your purpose and goals.

Thank you for reading until the end once again.

JPN ver.

コメント