ENG ver.

Hello, this is Pooh.

This time, I’d like to write about the allure of investing in U.S. stocks.

I have been mainly investing in individual U.S. stocks and mutual funds so far, while also holding some domestic stocks.

However, I have been focusing on increasing the proportion of U.S. stocks in my overall portfolio.

Why U.S. stocks, you may ask?

Aren’t Japanese stocks safer?

When we think of “stock investment,” we often first consider investing in Japanese companies. However, the Japanese economy has been facing stagnation and concerns about its future due to factors like a declining population.

On the other hand, if we look at the world, the U.S. economy’s scale and influence are incredibly significant, and its future prospects are highly promising, making it an attractive market.

So, in this article, I will summarize the allure of investing in U.S. stocks.

For those who are considering starting U.S. stock investment, I hope you find this information helpful.

Presence accounting for over 40% of the world’s stock market capitalization

Currently, most of the world’s leading companies are American.

Out of the top 10 companies in the world by stock market capitalization, seven are from the U.S., representing over 40% of the global market.

These well-known global giants operate not only within the U.S. but also globally.

Many of them have high-profit margins, strong competitive advantages, significant market share, and high operating profit rates.

High operating profit rates indicate that these companies have built strong business models with competitive advantages and possess profitable businesses.

Investing in such companies allows for stable asset management.

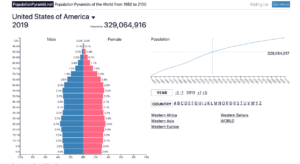

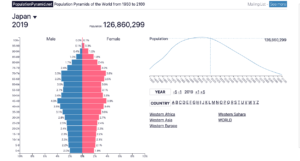

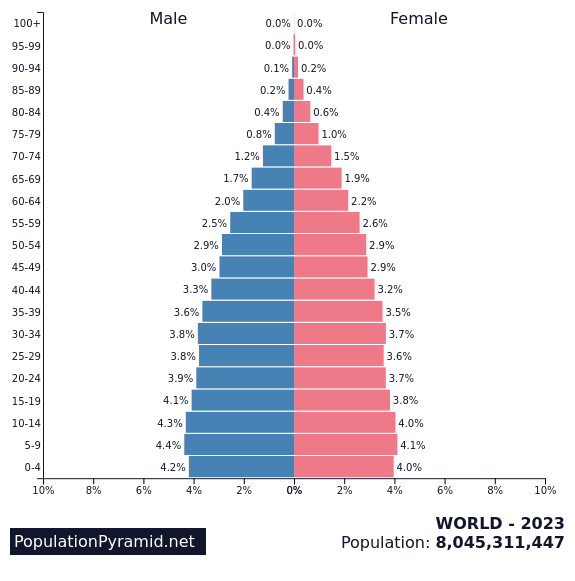

Population Growth in the U.S.

Considering the relationship with the economy from the perspective of the population, the U.S. is a country with a growing population.

Its population structure is ideal, with a large working-age population and fewer elderly people, forming a bell-shaped demographic distribution.

It is unlikely that the U.S. market will experience significant shrinkage due to population decline, and stable economic growth is expected.

Moreover, the purchasing power of Americans is very high, and domestic companies’ products and services sell well within the country.

Increased corporate earnings positively impact stock prices, making the population growth in the U.S. a positive factor for the economy.

In contrast, Japan is facing an aging population, and concerns are rising about the shrinking domestic market.

For long-term investments, it is recommended to invest in countries where the market is expanding.

High Stock Performance

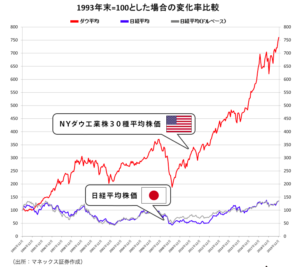

One of the charms of investing in U.S. stocks is their high performance.

The chart below compares the performance of the NY Dow Jones Industrial Average and the Nikkei 225 (both in dollar and yen terms) since 1994.

While the Nikkei 225 has shown signs of recovery, it has been mostly flat for over 20 years.

On the other hand, the U.S. stock market chart indicates that despite experiencing significant downturns like the IT bubble burst and the 2008 financial crisis, the stock prices have rebounded and continued to rise.

Although the U.S. stock market’s chart shows fluctuations, the resilience of U.S. stocks to recover even during severe economic downturns makes them attractive for long-term asset formation.

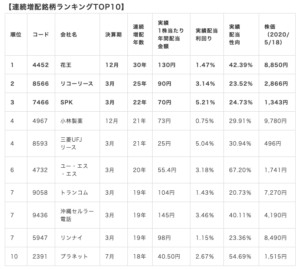

Emphasis on Shareholder Returns

The U.S. is a country known for its thorough capitalism.

Company executives and politicians prioritize increasing stock prices and rewarding shareholders.

Conversely, a drop in stock prices or dividend cuts is considered a failure as a company leader.

In the U.S., many companies have continuously increased dividends for many years.

For example, Procter & Gamble has been doing so for 63 years, and Coca-Cola for 58 years. There are many other companies with similar track records.

In Japan, dividend cuts are commonly heard of, which can be attributed to weaker business structures compared to U.S. companies.

During times of poor performance, Japanese management often struggles to determine whether the downturn is temporary or long-term, leading to temporary dividend cuts as emergency measures.

Although there are increasing Japanese companies that have consistently increased dividends for more than 20 years, they are still limited to around five companies.

From this data, we can see that U.S. stocks are more proactive in dividend payouts, while Japanese stocks tend to be more cautious.

What is crucial is whether a company can maintain or even increase dividends when its business performance declines and stock prices fall.

Many U.S. companies have demonstrated this ability even during economic downturns.

By investing in such companies, you can achieve stable long-term asset formation.

Propensity for Innovation

The term GAFA (Google, Apple, Facebook, Amazon) refers to the giant companies that lead the world today, and many of them are concentrated in the U.S.

These companies have introduced entirely new services and platforms, consistently driving innovation.

The U.S. is a breeding ground for such innovative companies, thanks to its ability to attract exceptional talent, with people coming to the U.S. to study and build networks at some of the world’s top universities.

According to global university rankings, nearly all the top 10 universities are in the U.S. As a result, top talents from around the world come to the U.S. to attend these prestigious institutions.

Furthermore, many promising venture companies called “unicorns” that meet the following conditions have emerged in the U.S.:

- Founded within the last 10 years

- Valued at over $1 billion

- Not listed on the stock market

- Technology companies

In 2018, the number of unicorns in the U.S. was 151 (compared to 118 in the previous year), while China had 82 (62 in the previous year), the UK had 16 (13 in the previous year), and India had 13 (9 in the previous year).

Japan had only one, demonstrating the significant presence of U.S. unicorns. (Source: Nikkei)

Given these factors, investing in the U.S. market, either in individual promising stocks or in an index fund or ETF that covers the entire U.S. market, seems to be a highly promising option for long-term investment.

Summary

- Dominant Presence with Over 40% of the Global Stock Market Capitalization:

The U.S. holds a commanding presence, accounting for over 40% of the world’s total stock market capitalization. Many globally recognized companies are based in the United States, boasting high operating profit margins. - Population Growth in the U.S.:

The U.S. is a country experiencing population growth, with a bell-shaped demographic distribution, and its domestic market is expected to expand further. - Strong Stock Performance:

The resilience of U.S. stocks is particularly attractive, as they consistently rebound and show upward trends even during significant economic downturns. - Emphasis on Shareholder Returns:

Many U.S. companies prioritize shareholder returns, with numerous examples of continuous dividend increases over many years, reflecting a strong commitment to rewarding shareholders. - Favorable Environment for Innovation:

The U.S. attracts exceptional talent from around the world, fostering an environment that nurtures innovation. Companies like GAFA (Google, Apple, Facebook, Amazon) continue to emerge, driving further innovation.

In this article, I’ve summarized the allure of investing in U.S. stocks.

As the world’s largest economy, the U.S. stands out with a significant scale, setting it apart from China and Japan, ranked second and third, respectively.

Considering factors such as economic size, population dynamics, stock performance, differences in stock market attitudes, and the fertile ground for promising companies, the U.S. possesses unique appeal that other countries lack.

For those seeking long-term investments and unsure about which country’s stocks to invest in, investing in U.S. stocks, which represent the world’s largest market, is an option that cannot be overlooked.

Moreover, investing in U.S. stocks has become more accessible lately, with smartphones providing easy access to investment opportunities.

With services allowing purchases of even a single share or starting with as little as ¥1,000, small-scale investments have become feasible.

Investing in promising individual U.S. stocks or holding a set of U.S. stock assets through index funds or ETFs that cover the entire market can yield stable returns of several percent annually.

Finally, I recommend reading books by バフェット太郎, and the works by both 両学長, as they delve deeper into the content covered in this article and provide valuable insights.

Thank you for reading until the end.

Pooh

コメント