ENG ver.

Hello, this is Pooh.

In this article, I would like to write about the “Dow Jones Industrial Average,” “NASDAQ,” and “S&P 500.”

In a previous article, I discussed the differences between the Nikkei Stock Average and TOPIX.

I primarily invest in index funds, but I realized that my understanding of these indices (indexes) is not very clear.

So, continuing from the last time, I will continue to research and deepen my understanding of these indices.

This time, I will focus on the three representative indices of the United States: Dow Jones Industrial Average (often referred to as “Dow”), NASDAQ, and S&P 500.

What is the Dow?

You often hear about the “Dow” in the news, referred to as the “Dow Average” or “New York Dow,” among other names, but its official name is the “Dow Jones Industrial Average.”

This index is published by Dow Jones & Company, the publisher of The Wall Street Journal.

It is the oldest index in the world, with its calculation starting in 1896, and it represents the overall movement of the U.S. stock market.

The index is calculated based on the fluctuations of 30 representative stocks listed on the New York Stock Exchange and NASDAQ.

This is somewhat similar to the Nikkei Stock Average, which is composed of 225 representative Japanese companies and is published by the Nihon Keizai Shimbun.

By the way, in the U.S., there are two major stock markets: the New York Stock Exchange (NYSE) and the NASDAQ market, which I will talk about later.

The NYSE is the world’s largest stock exchange and is home to many well-known companies.

On the other hand, NASDAQ is the world’s largest stock market for venture companies, with a large number of IT-related companies listed.

As we can see, the constituents of the Dow Average are also selected from the NYSE and NASDAQ.

One notable feature of the Dow Average is that it consists of only 30 stocks, which is relatively small compared to other indices.

The top 10 stocks in the Dow Average account for over half of the entire index’s value.

Therefore, the movements of these top stocks have a significant impact on the overall performance of the Dow Average.

What is NASDAQ?

As mentioned earlier, NASDAQ is the world’s largest stock market for venture companies.

Its official name is “National Association of Securities Dealers Automated Quotations.”

When translated into Japanese, it means “Automated Quotations by the National Securities Dealers Association,” and it gained attention as the world’s first electronic stock market in 1971.

Currently, it is home to numerous IT-related companies such as Amazon, Apple, Google (Alphabet), Microsoft, and Facebook.

Japanese companies, such as Tokio Marine Holdings, Nintendo, and Nissan, are also listed on NASDAQ.

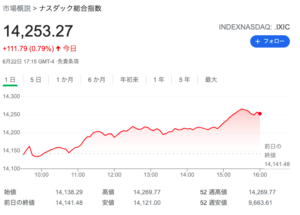

The “NASDAQ Composite Index” that we often see in the news refers to all the stocks listed on NASDAQ, calculated as a market-capitalization-weighted average.

In other words, it is an index based on the total market capitalization of all the listed companies rather than just the average stock prices, and it is calculated in points, with a base value of 100 as of its inception on February 5, 1971.

As of June 22, 2021, the index value is 14,253.23.

What is S&P 500?

S&P 500 (Standard & Poor’s 500 Stock Index) is calculated by S&P Dow Jones Indices, a company that provides financial market indices.

It consists of 500 representative stocks from various exchanges, including NYSE and NASDAQ.

The calculation involves weighting the stocks by market capitalization to create the index.

The S&P 500 Index covers approximately 80% of the total market capitalization of the U.S. stock market, making it a significant indicator for understanding the overall performance of the U.S. market.

One distinctive feature of the S&P 500 is that the constituents are weighted based on their market capitalization.

As a result, companies with high market capitalization have a greater influence on the index’s performance.

Having 500 companies in the index helps reduce the impact of individual stock fluctuations on the overall index performance.

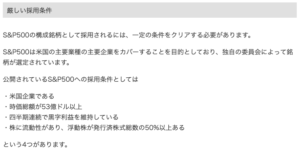

Stringent Inclusion Criteria for S&P 500

While researching the S&P 500, I found that it has strict inclusion criteria.

Companies must have a market capitalization of at least $5.3 billion (approximately 587.6 billion yen) and maintain continuous profits for quarters to be considered for inclusion.

This means that the S&P 500 consists of only stable and financially sound companies that meet these criteria.

Moreover, companies that lose momentum are replaced with more promising ones, resulting in a composition that suits the current market trends.

At present, we can see that globally renowned IT companies like GAFAM dominate the index’s composition.

From an investor’s perspective, owning an index fund that tracks the S&P 500 allows for stable performance, as long as the U.S. economy continues to grow.

While the Dow Average is more widely known to the general public, the S&P 500 is more commonly used as a benchmark for evaluating investment performance in U.S. stocks.

Since various financial institutions offer index funds linked to the S&P 500, even those starting with small investments might consider having one.

Summary

The NY Dow refers to the “Dow Jones Industrial Average,” which represents the average stock prices of 30 representative companies from various industries.

NASDAQ is the world’s largest stock market for venture companies, and the “NASDAQ Composite Index” reflects the total market capitalization of all NASDAQ-listed companies.

S&P 500 is an index composed of 500 representative stocks from NYSE, NASDAQ, and other exchanges, and its performance is weighted by market capitalization.

Each index has its unique characteristics and inclusion criteria, making them suitable for different investment strategies.

I hope this article helps you better understand the differences between the Dow, NASDAQ, and S&P 500.

Even though we often see different indices on the news, their variations are due to differences in constituent companies and index calculation methods.

While I thought I knew a little about indices, I have realized there was much I didn’t know, and I have gained a deeper understanding from this research.

As I primarily invest in index funds, I feel a sense of reflection that I didn’t fully understand the most crucial aspect, which is the indices themselves.

Moving forward, I will make informed choices when selecting index funds, considering which market, constituent companies, and price movements I want to invest in.

Thank you for reading this article once again.

Pooh

JPN ver.

コメント